-

The Feminist Botanist

A 19th-century tale of hermaphrodite flowers, Charles Darwin, and women’s right to vote.

-

The Shark Whisperer

Donald Nelson spent his life undoing the damage that Jaws did to the perception of sharks.

-

Nine Rebel Astronomy Theories That Went Dark

Bright ideas from astronomy’s biggest stars haven’t always worked out.

The Porthole

Short sharp looks at science

-

What a Bronze Age Skeleton Reveals About Cavities

Here’s a hint: He didn’t eat processed foods and sugar.

-

Archaeology at the Bottom of the Sea

David Gibbins on his 3 greatest revelations while writing A History of the World in Twelve Shipwrecks.

Get the best of Nautilus. Become a member today.

Join now-

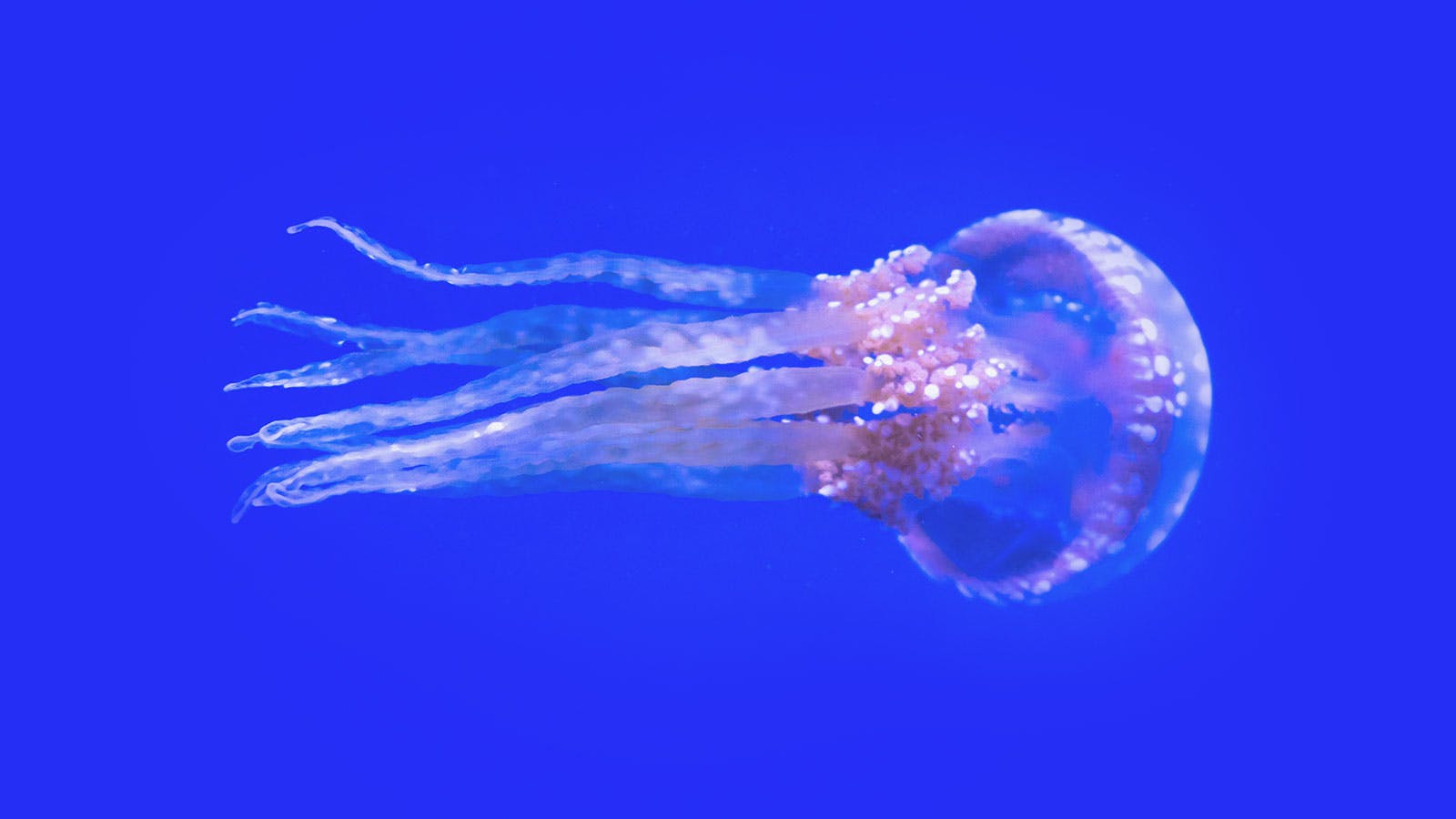

The Marvelous Seamounts of the Southeast Pacific

An expedition to a little-explored region returns with deep-sea wonders.

-

The Ocean Apocalypse Is Upon Us, Maybe

What we know—and don’t know—about a crucial climate tipping point.

-

The Women Who Found Liberation in Seaweed

How a shared love of algae got a community of women hooked on marine science.

-

The Invasive Species

When it comes to tinkering with nature, our résumé is a list of breathtaking mistakes.

-

He Closed the Gap Between Humans and Apes

Frans de Waal saw animal behavior with fresh eyes and forever enriched our understanding of primates.

-

The End of the Dark Universe?

A new “post-quantum” theory of gravity says we can wave dark matter and dark energy goodbye.

-

Does Science Fiction Shape the Future?

Conversations with visionary science fiction authors on the social impact of their work.

-

Do Our Oceans Feel the Tug of Mars?

Ancient currents seemed to move in concert with a 2.4 million-year dance between the Red Planet and Earth.

-

Let’s Get Granular

Scientists have long puzzled over the behavior of mixed particles in rivers and landslides. New clues could be groundbreaking.

-

When Calamity Comes at a Crawl

Climate change may exacerbate the quiet catastrophe of slow-moving landslides.

-

The Part-Time Climate Scientist

A humble steam engineer put humans in the driver’s seat. -

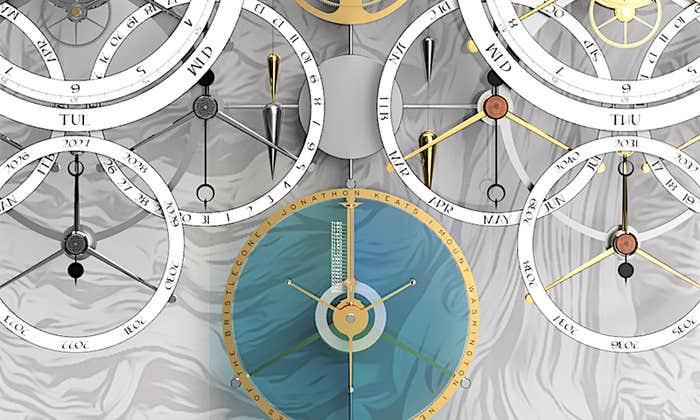

A Revolution in Time

Why clocks need to follow the tempo of nature. -

Lithium, the Elemental Rebel

What a missing element can teach us about the universe. -

The Marine Biologist Who Dove Right In

He changed the study of ocean life by getting in the water. -

The Rebel Issue

How we change the world. -

Viva la Library!

Rebel against The Algorithm. Get a library card. -

The Prizefighters

If you want to know what it takes to succeed in science, head to the Nobel Prize ceremony. -

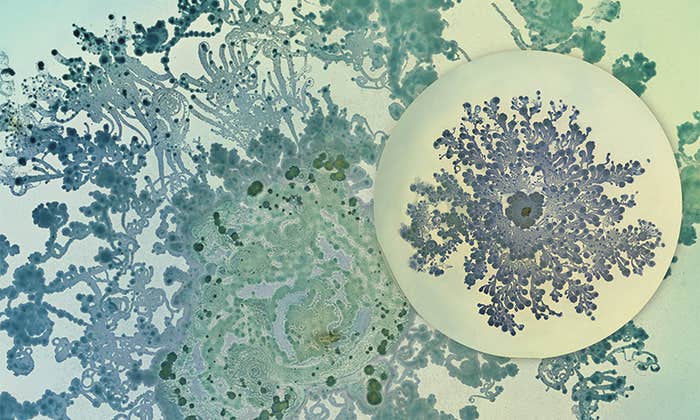

The Bacteria That Revolutionized the World

How cyanobacteria killed one climate and created our habitable Earth. -

How a Total Eclipse Alters Your Psyche

The importance of feeling small and insignificant. -

Doubts Grow About the Biosignature Approach to Alien-Hunting

Recent controversies bode ill for the effort to detect life on other planets by analyzing the gases in their atmospheres. -

When Bacteria Are Beautiful

Making art out of an invisible world that shapes human health and disease. -

How Much Carbon Can a Tree Really Store?

A new study says climate change is messing with the math. -

When Sleep Deprivation Is an Antidepressant

For some, a night without sleep causes mood-boosting changes in the brain. -

How Different Instruments Shape the Music We Love

The timbre of a violin or a sitar can affect how dissonant music sounds to us. -

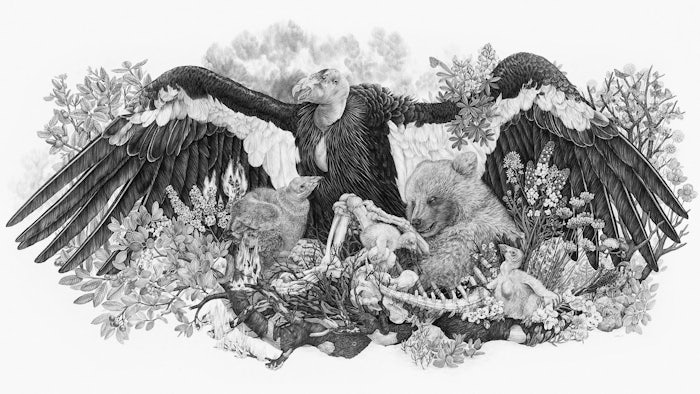

The Unseen Deep-Sea Legacy of Whaling

It’s not just whales who were decimated, but the creatures who live where they fall. -

Everything in Its Right Place

When a misplaced sense of familiarity gives rise to delusions of place. -

Scientists and Artists as Storytelling Teams

A conversation with artist and naturalist Zoe Keller. -

These Eyes Shine Light on the Path of Evolution

The visual systems of a group of mollusks reveal how future evolution depends on the past. -

Why Bats Are Flying Machines

Nearly everything about this tiny mammal is shaped by its powers of flight.